Form 2555 2018

Only income earned outside of the us qualifies for the feie. Next to the amount on schedule 1 form 1040 line 36 enter form 2555 add it to the total adjustments to income reported on line 36.

Us Expat Taxes Form 2555 Ez Foreign Earned Income Exclusion

Enter the amount from your 2019 form 2555 line 47.

Form 2555 2018. Complete the foreign earned income tax worksheet in the instructions for form 1040 if you enter an amount on line 45 or 50. Form 2555 instructions irs form 2555 example analysis 2018 golding golding tax specialist form 2555 instructions foreign earned income irs 2555 exclusion irs form 2555 is the foreign earned income exclusion form. B date left us.

Enter the smaller of line 3 or line 6 here and on line 49 of your 2018 form 2555. Next to the amount enter form 2555 on schedule 1 form 1040 or 1040 sr subtract this amount from your additional income to arrive at the amount reported on schedule 1 form 1040 or 1040 sr line 9. You do not have any housing deduction carryover from 2018.

12 a date arrived in us. If line 3 is more than line 6 you cannot carry the difference over to any future tax year. Form 2555 foreign earned income department of the treasury internal revenue service omb no.

C number of days in us. Form 2555 ez 2018 page. Enter the amount from your 2018 form 2555 line 48.

Enter the amount from your 2018 form 2555 line 48. Subtract line 5 from line 4. Instructions for form 2555 foreign earned income related forms form 673 statement for claiming exemption from withholding on foreign earned income eligible for the exclusions provided by section 911.

That is to say us source income goes on form 1040 and not form 2555. Enter 0 on line 49 of your 2019 form 2555. Enter the amount from your 2018 form 2555 line 46.

Enter the total here and on schedule 1 form 1040 to the left of line 36. 2 part iii days present in the united states complete this part if you were in the united states or its possessions during 2018. Subtract line 2 from line 1.

Add lines 48 and 49. If the result is zero stop. Instructions for form 2555 2018 5.

The foreign earned income exclusion for 2018 is to be reported on your 2018 personal income tax return using form 1040 and form 2555. 1545 0074 2018 attach to form 1040. On business d income earned in us.

The form is used primarily by expats who meet the irs foreign earned income exclusion.

Https Kirstengillibrand Com Wp Content Uploads 2019 03 2018 Gillibrand Tax Return Pdf

Form 2555 Foreign Earned Income Exclusion Youtube

Tax Reform For Us Expats

Index Of Wp Content Uploads 2019 04

Tax Form Changes Coming In 2019 Taxslayer Pro S Blog For

Adjusted Gross Income On 1040 2018

The Go Curry Cracker 2018 Taxes Go Curry Cracker

Us Expat Tax Guide To Form 2555 Myexpattaxes

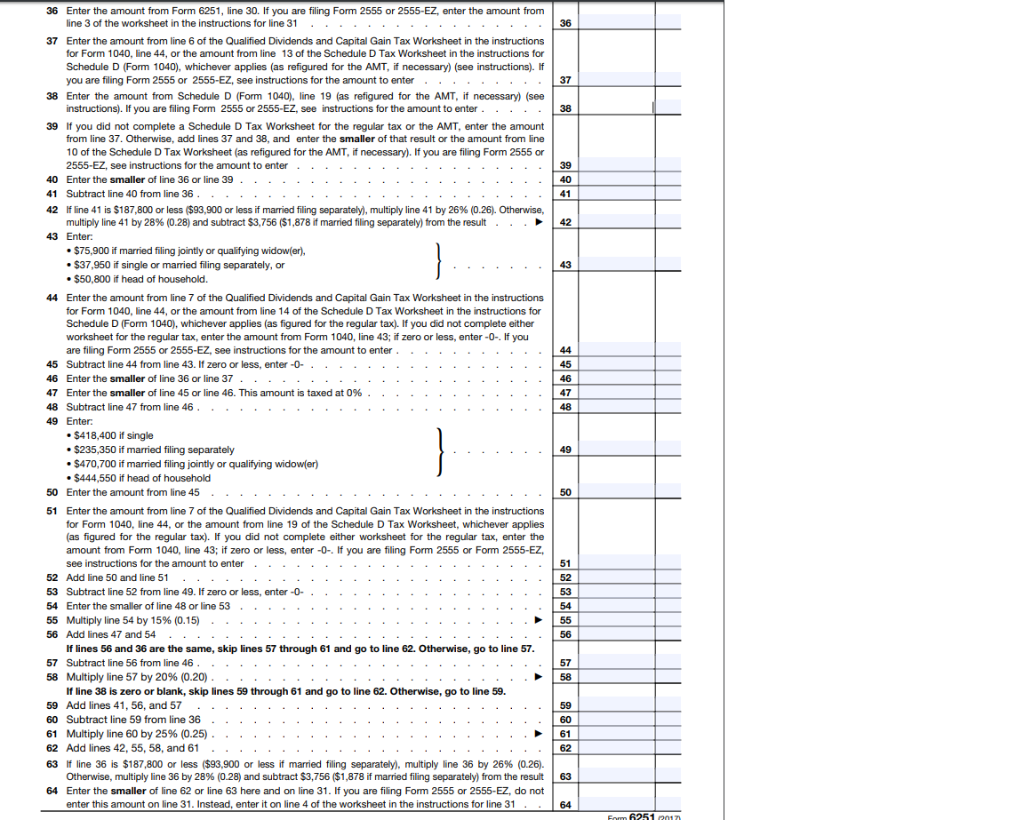

Solved In 2018 Nadia Has 100 000 Of Regular Taxable Inc