Form 2441 Tax

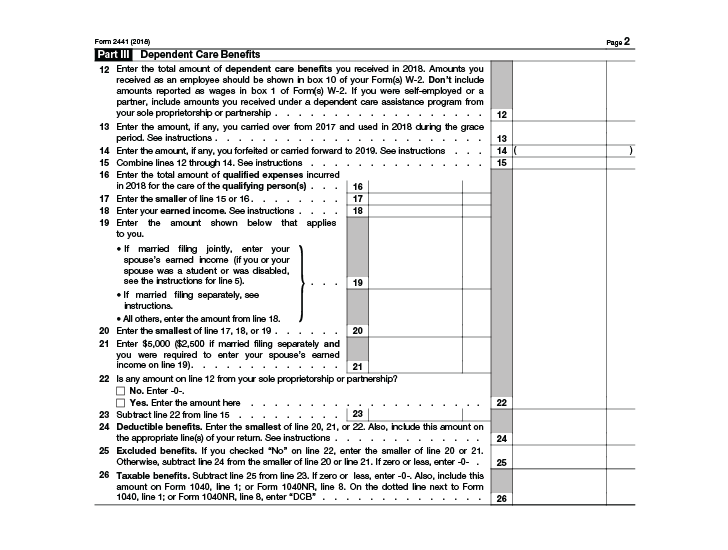

As you prepare form 2441 youll notice it includes a line to report your earned income. You must complete part iii of form 2441 before you can figure the credit if any in part ii.

2016 Simple Tax Form 2441 Youtube

Only expenses that are directly related to you looking for work or working will qualify for a tax credit.

Form 2441 tax. Use form 2441 to figure the amount if any of the benefits you can exclude from your income. In limited circumstances however earned income will include other payments that arent earned at work or in your business. Form 2441 department of the treasury internal revenue service 99 child and dependent care expenses attach to form 1040 1040 sr or 1040 nr.

The process of calculating your credit is simple addition subtraction and multiplication. In part i youll write the names or the person or people who provided the care you paid for. Things like food clothing and housing wont be exempt on tax form 2441.

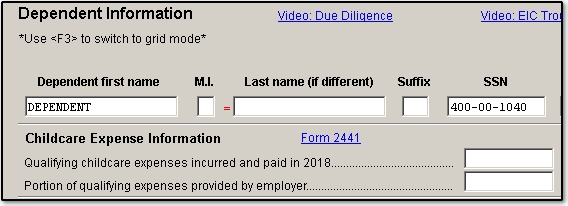

Form 2441 child and dependent care expenses is an internal revenue service irs form used to report child and dependent care expenses on your tax return in order to claim a tax credit for those. You must complete part iii of form 2441 before you can figure the credit if any in part ii. It will be helpful to have your tax return as well as your form w 2 the form 2441 worksheet will lead you through recording this info and using it to figure out how much of a credit you can claim.

Or form 1040nr line 59a. If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses. You and your spouse if filing jointly must have earned income to take the credit or exclude dependent care benefits from your income.

You and your spouse if filing jointly must have earned income to take the credit or exclude dependent care benefits from your income. Some of the more common uses of form 2441 are writing off the cost of daycare for your children nannies and professional caretaking services. The irs defines earned income as the money you receive from employment and self employment activities.

Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit. For details see the instructions for schedule 4 form 1040 line 60a. But see if you or your spouse was a student or disabled later if either of these circumstances apply.

If the care was provided in your home you may owe employment taxes. The point of form 2441 is to prove to the irs that youre eligible for the child and dependent care tax credit to indicate the eligible care costs you incurred during the tax year and to declare your income.

What Is Irs Form 2441 And How Do I Claim It Civic Tax Relief

Lesson 7 Credit For Child And Dependent Care Expenses Ppt Download

Irs Releases 2016 Form 2441 And Instructions For Reporting Child

All About Irs Form 2441 Smartasset

2441 Child And Dependent Care Credit W2

2017 Form 2441 Fill Out And Sign Printable Pdf Template Signnow

Tax Form 2441 Instructions Info On Child Dependent Care Expenses

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

Form 2441 Definition

Filing Tax Form 2441 Child And Dependent Care Expenses Turbotax