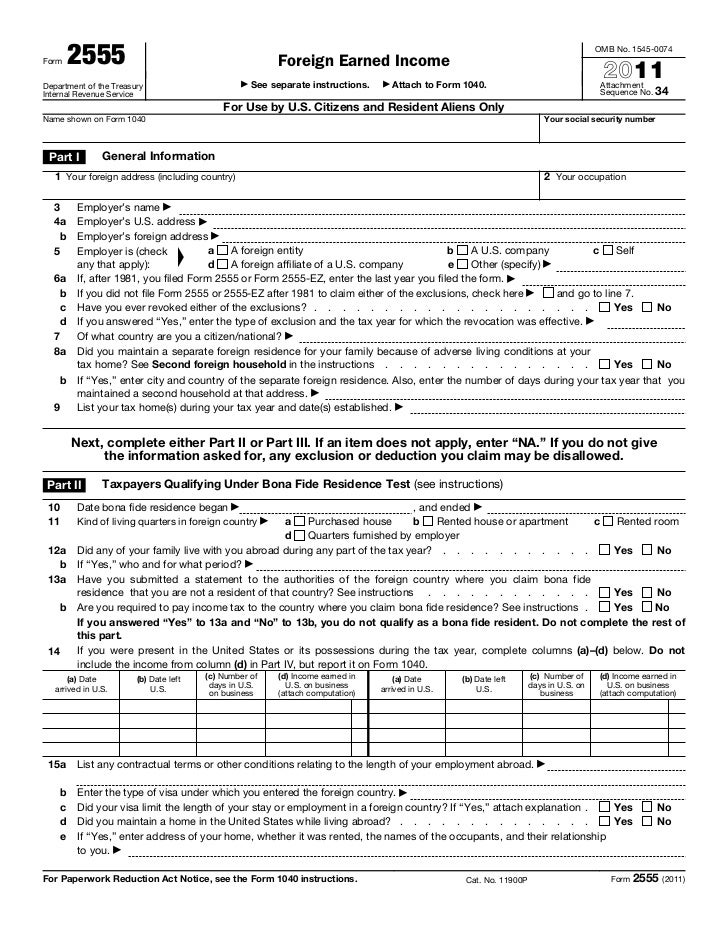

Form 2555

If you reside outside of the united states but still need to file a us. Publication 54 tax guide for us.

2012 Instructions For Form 2555 Internal Revenue Service

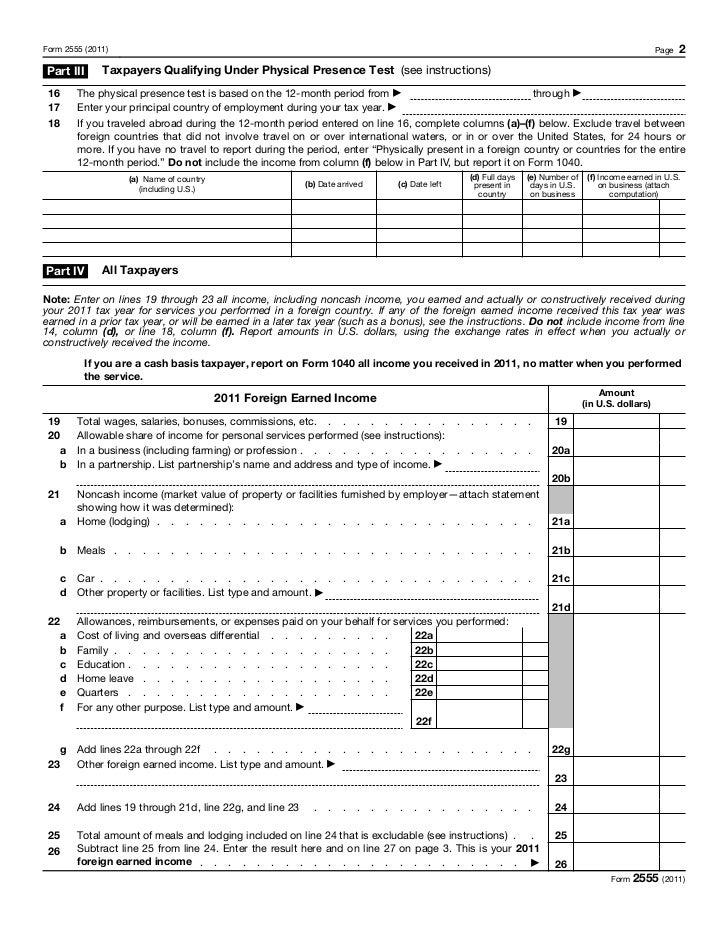

Tax form 2555 is used to figure the foreign earned income exclusion and housing exclusion or deduction.

Form 2555. Beginning with tax year 2019 all taxpayers will be required to use the form 2555 to claim the foreign earned income exclusion. If you are preparing your own taxes you may gravitate toward the ez option as it is easier and has fewer pages to complete. If you claim exclusion under the bona fide residence test you should fill out parts i ii iv.

Heres how to addor removea form 2555 or 2555 ez from your return. If you meet the requirements you can complete form 2555 the foreign earned income exclusion to exclude your foreign wages or salary from income earned in the foreign country. Both form 2555 and form 2555 ez will work when it comes to claiming the foreign earned income exclusion.

Taxpayers may be able to claim an exclusion for income earned while they lived and worked in a foreign country if they qualify under the bona fide residence test or the physical presence test and if they have a foreign tax home. Form 2555 department of the treasury internal revenue service foreign earned income attach to form 1040 or 1040 sr. Sign into turbotax and open or continue your return.

Common questions we receive include. Bona fide residence test. You can download or print current or past year pdfs of form 2555 directly from taxformfinder.

Complete the foreign earned income tax worksheet in the instructions for forms 1040 and 1040 sr if you enter an amount on line 45 or line 50. You may also qualify to exclude compensation for certain foreign housing costs or your personal services. The form 2555 ez will no longer be available to make the election to exclude foreign earned income and the foreign housing cost amount.

Form 2555 instructions foreign earned income irs 2555 exclusion irs form 2555 is the foreign earned income exclusion form. Tax return you may qualify for irs form 2555 aka the foreign earned income exclusion. You can print other federal tax forms here.

Form 2555 ez is a simplified version of this form. Citizens and resident aliens abroad form 2555 and form 2555 ez. The difference between the two forms is primarily the level of difficulty in completing the forms.

More about the federal form 2555 individual income tax ty 2019 we last updated the foreign earned income in february 2020 so this is the latest version of form 2555 fully updated for tax year 2019. The form is used primarily by expats who meet the irs foreign earned income exclusion. Form 2555 foreign earned income exclusion calculates the amount of foreign earned income andor foreign housing you can exclude from taxation.

:brightness(10):contrast(5):no_upscale()/159674556-56a938983df78cf772a4e4b7.jpg)

You Might Be Able To Exclude Up To 105 900 In 2019

Horizontal Photo Of Partial Irs Income Tax Form 2555 For Foreign

Https Www Irstaxforumsonline Com Sites Default Files Players Calfe17 Downloads Calfe17slides Pdf

Form 2555 Foreign Earned Income

Irs Form 2555 Instructions For American Expats Guide

Form 2555 Ez U S Expat Taxes Community Tax

Key Basics Of Form 2555 Filetaxes Online Blog

Us Tax Abroad Expatriate Form 2555

Us Tax Abroad Expatriate Form 2555