Form 2210

You request a. Underpayment of estimated tax by individuals estates and trusts 2019 02192020 inst 2210.

Form 2210 Archives The National Society Of Tax Professionals

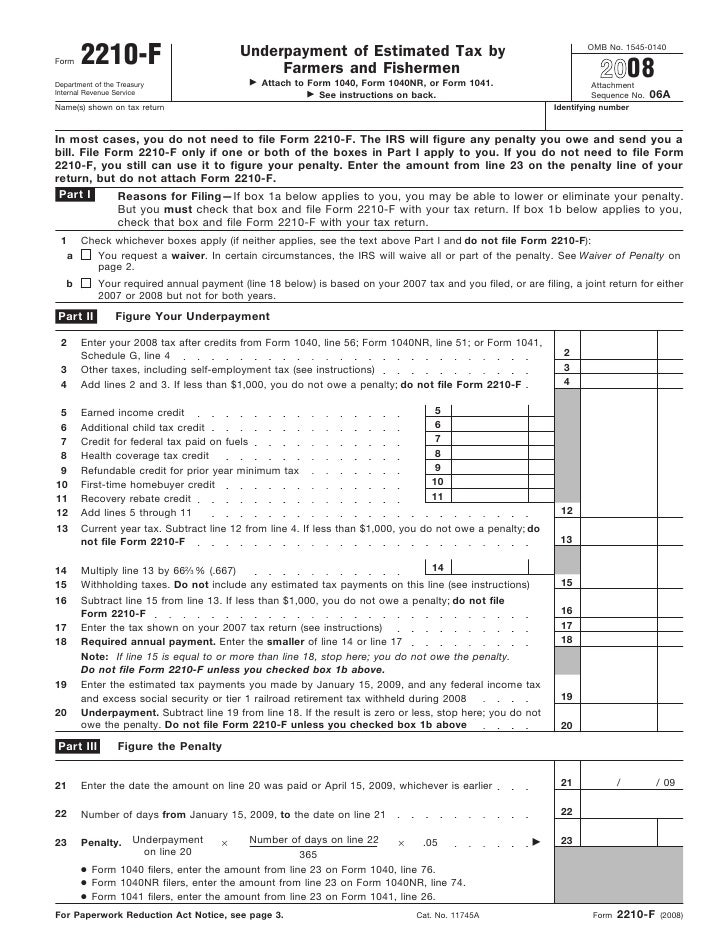

When using form 2210 f refer to the instructions for form 2210 f which discuss special rules that may apply.

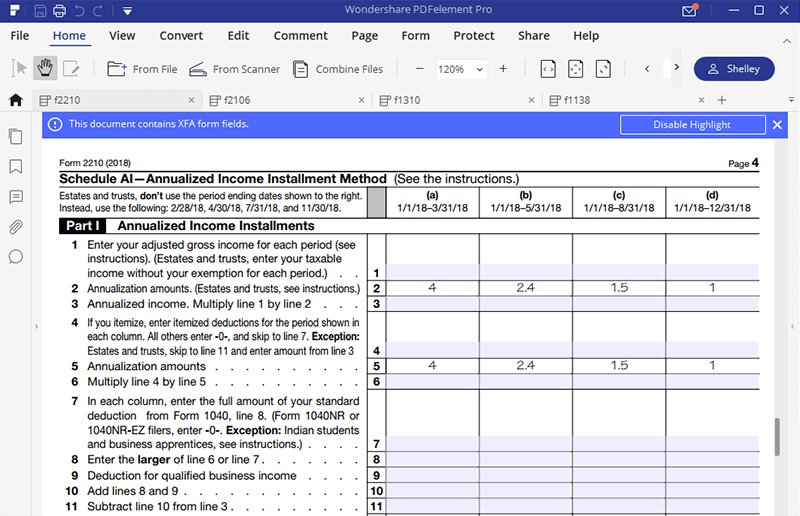

Form 2210. If a taxpayer does not honor an irs installment agreement the irs measures the tax deficiency by comparing each quarterly payment as it appears in form. For more information about the federal income tax see the federal income tax page. Use form 2210 to see if you owe a penalty for underpaying your estimated tax and if you do to figure the amount of the penalty.

If you dont meet test 1 use form 2210. Information about form 2210 f underpayment of estimated tax by farmers and fishermen including recent updates related forms and instructions on how to file. Information about form 2210 underpayment of estimated tax by individuals estates and trusts including recent updates related forms and instructions on how to file.

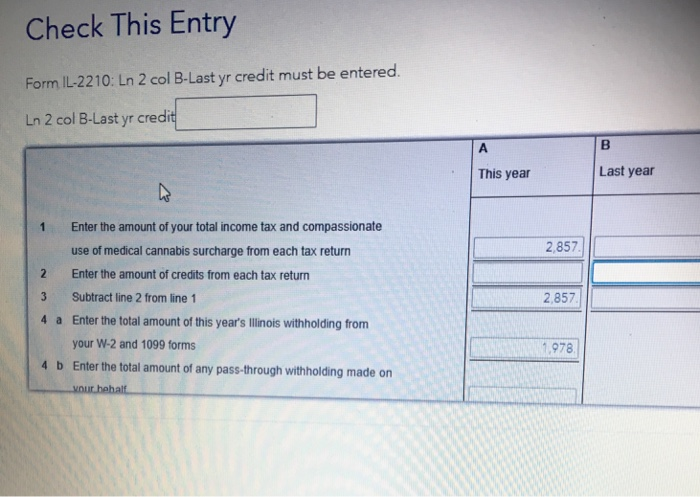

If box b c or d in part ii is checked you must figure the penalty yourself and attach form 2210 to your return. Irs form 2210 underpayment of estimated tax by individuals estates and trusts calculates the underpayment penalty if you didnt withhold or pay enough taxes during the tax year. There are some situations in which you must file form 2210 such as to request a waiver.

Waiver see instructions of. Waiver see instructions of your entire penalty. If you meet test 1 but not test 2 use form 2210 f underpayment of estimated tax by farmers and fishermen to see if you owe a penalty.

If you failed to pay or underpaid your previous years estimated income tax use form 2210 to calculate file and pay any penalties or fees due with your late payment. File only page 1 of form 2210. The irs uses form 2210 for underpayment of estimated tax form 2210 f for farmers and fishermen to track whether estimated taxes have been paid in full and on time.

Instructions for form 2210 underpayment of estimated tax by individuals estates and trusts 2019 02192020 form 2210 f. Underpayment of estimated tax by farmers and fishermen. Printable federal income tax form 2210.

Form 2210 underpayment of estimated taxes the irs expects that you will pay the taxes you owe throughout the year. Those with at least 23rds of annual income from farmingfishing use form 2210 f to determine any penalty for underpaying estimated tax. You must check this box and file page 1 of form 2210 but you arent required to figure your penalty.

Form 2210 f is a variation if you made at least 23 of your gross income from farming or fishing. These estimated taxes are to be paid quarterly april 15th june 15th september 15th and january. This is done either through witholdings from your earnings or by the payment of estimated taxes using estimated payment vouchers.

Part ii reasons for filing. The irs will figure the penalty. Who must file form 2210 use the flowchart at the top of form 2210 page 1 to see if you must file this form.

If none apply dont.

2210 Military Enlistments Montana World War I Montana

2

Https Resources Taxschool Illinois Edu Taxbookarchive 2013 C4 20estimated 20taxes Pdf

Tax Penalty For Failure To File Failure To Pay Or For Underpaying

Solved Where Can I Find This Form 2210 It S In 1040 If

Irs Extends March 1 Filing Deadline For Farmers Center For

Form 2210f Underpayment Of Estimated Tax Farmers And Fishermen

Form 2210 F Underpayment Of Estimated Tax By Farmers And

Irs Form 2210 Fill It With The Best Form Filler