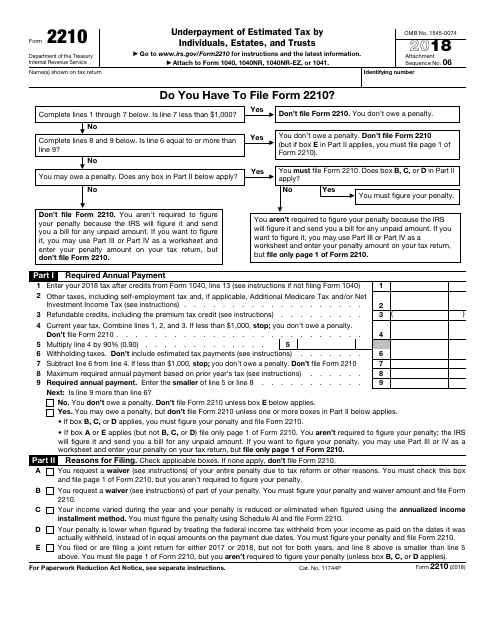

Form 2210 Instructions 2020

Waiver see instructions of your entire penalty. You can however use form 2210 to figure your penalty if you wish and include the penalty on your return.

Free State And Federal Tax Filing Options For 2020 Clark Howard

Form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes quarterly es vouchers.

Form 2210 instructions 2020. Your best solution to fill out irs form 2210 to fill out the irs 2210 you can undoubtedly use pdfelement which has all the built in features required for form filling. Underpayment of estimated tax by individuals estates and trusts 2019 02192020 inst 2210. Instructions for form 2210 underpayment of estimated tax by individuals estates and trusts 2019 02192020 form 2210 f.

Instructions for form 2210 html. Apple preview pdf reader does not support calculations in forms. Use this form to see if you owe a penalty for underpaying your estimated tax and if you do to figure the amount of the penalty.

There are some situations in which you must file form 2210 such as to request a waiver. Enter the penalty on form 2210 line 27 and on the estimated tax penalty line on your tax return. Notice 2019 55 changed the 2210 waiver guidelines for 2018.

Open the form using a pdf reader that supports the ability to complete and save pdf forms. Who must file form 2210 use the flowchart at the top of form 2210 page 1 to see if you must file this form. You must figure your penalty and waiver amount and file form 2210.

Underpayment of estimated tax by farmers and fishermen 2019. Instructions for form 2210 2019 underpayment of estimated tax by individuals estates and trusts section references are to the internal revenue code unless otherwise noted. About form 2210 underpayment of estimated tax by individuals estates and trusts.

Underpayment of estimated tax by farmers and fishermen. Waiver see instructions of part of your penalty. Underpayment of estimated tax by individuals estates and trusts 2019 02192020 inst 2210.

Instructions for form 2210 underpayment of estimated tax by individuals estates and trusts 2019 02192020 form 2210 f. See the form 2210 instructions for details. Form 2210 is not generated unless there is an underpayment and the form is required.

Form 2210 line 17 and on the estimated tax penalty line on your tax return. Note for apple users. If you use the regular method complete part i check the boxes that applies in part ii complete part iv section a and the penalty worksheet later.

Print the form using the print form button on the form for best results. The iris form 2210 is titled as the underpayment of estimated tax by individuals estates and trusts which is issued by the department of the treasury internal revenue service of united states of america. Adobes acrobat reader is free and is the most popular of these programs 5.

This penalty is different from the penalty for paying your taxes late. You request a. You must check this box and file page 1 of form 2210 but you arent required to figure your penalty.

You should not file form 2210.

1040 2019 Internal Revenue Service

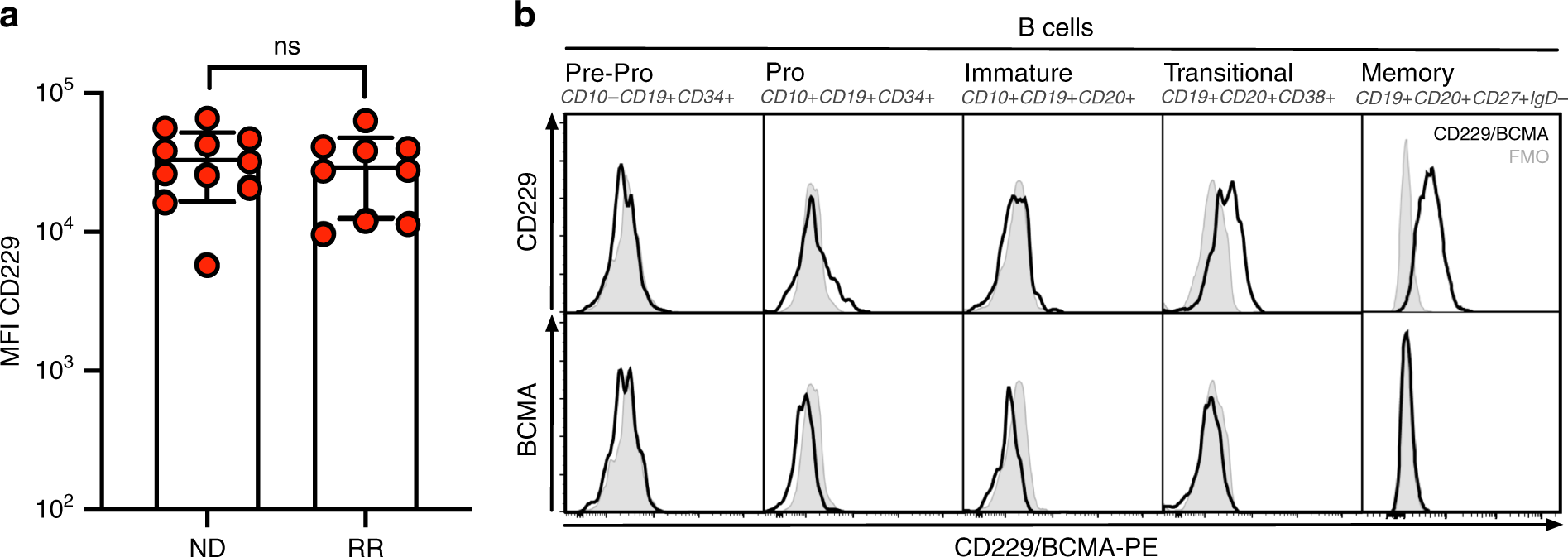

Cd229 Car T Cells Eliminate Multiple Myeloma And Tumor Propagating

Irs Form 2210 Download Fillable Pdf Or Fill Online Underpayment Of

Irs Offers Tax Penalty Relief To Some Who Didn T Have Enough

Https Portal Ct Gov Media Drs Forms 2019 Income Ct 1040 Online Booklet 1219 Pdf La En

1040 2019 Internal Revenue Service

Https Dor Mo Gov Forms Mo 1040 20instructions 2019 Pdf

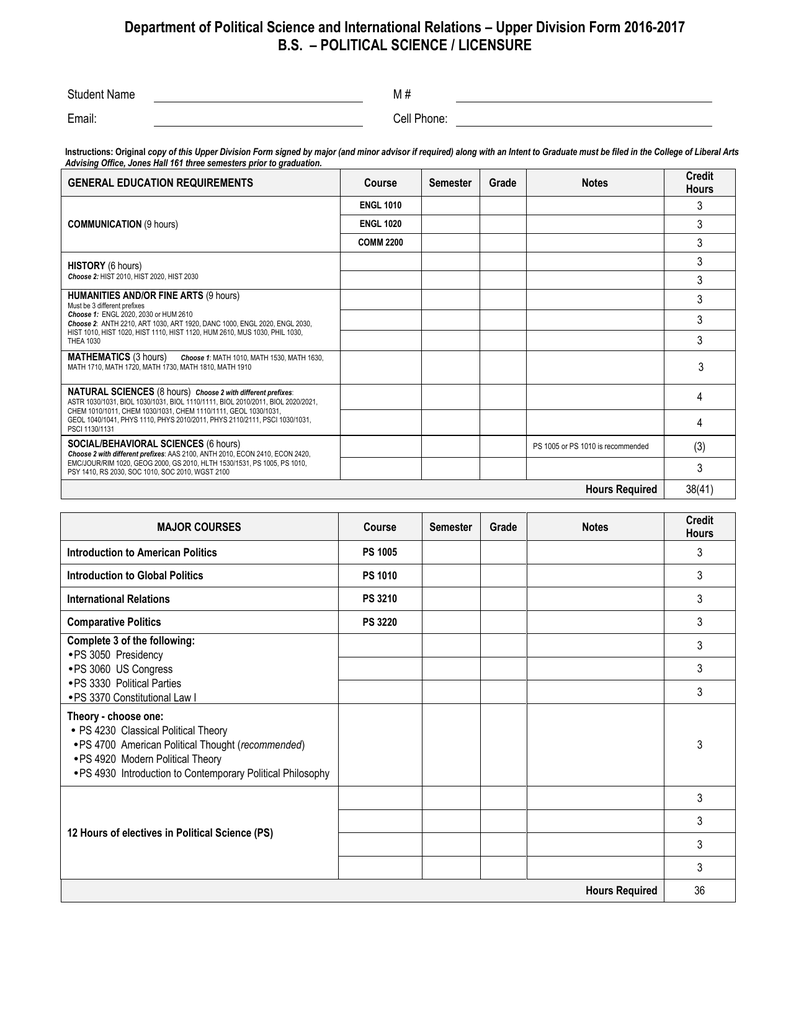

Department Of Political Science And International Relations

Https Www Tax Ohio Gov Portals 0 Forms Ohio Individual Individual 2019 Pit It1040 Booklet Pdf