Irs Form 2210 For 2017

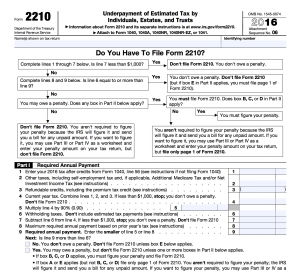

Underpayment of estimated tax by individuals estates and trusts 2017 inst 2210. 2 part iii short method can you use the short method.

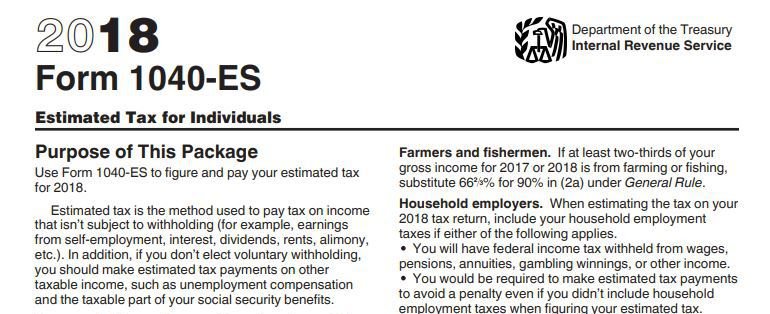

Tax Underpayment Penalty Relaxed By Irs For Some 2018 Taxpayers

2210 2017 form 2210 2017 page.

Irs form 2210 for 2017. Dont file form 2210. Special rules for certain individuals. Internal revenue service underpayment of estimated tax by.

If the taxpayers agi for 2016 was more than 150000 then to avoid penalty the estimated payments would have to be at least 110 of the 2016 tax liability to avoid an underpayment penalty for 2017. Instructions for form 2210 underpayment of estimated tax by individuals estates and trusts 2017 form 2210. Do i need to file irs form 2210 for 2017.

There is an exception to what turbotaxdianew says. If you want to figure it you may use part iii or part iv as a worksheet and enter your penalty amount on your tax return but. Your 2016 tax return must cover a 12 month period.

Underpayment of estimated tax by individuals estates and trusts 2016 inst 2210. In general you may owe the penalty for 2017 if the total of your withholding and timely estimated tax payments didnt equal at least the smaller of. You can use the short method if.

You made no estimated tax payments or your only payments were withheld federal income tax or. You arent required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Dont file form 2210.

90 of your 2017 tax or 2. Use this form to see if you owe a penalty for underpaying your estimated tax and if you do to figure the amount of the penalty. 100 of your 2016 tax.

About form 2210 underpayment of estimated tax by individuals estates and trusts.

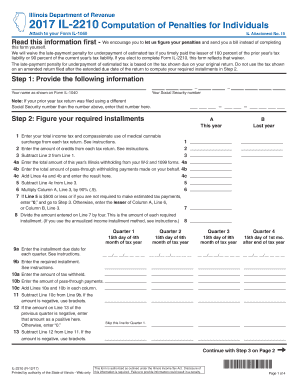

Il 2210 Fill Out And Sign Printable Pdf Template Signnow

Blog Form 1040 Schedule A E File Available Taxact 2017

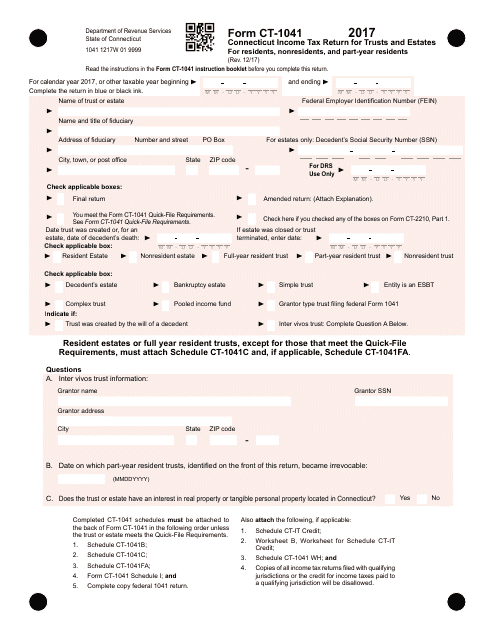

Form Ct 1041 Download Printable Pdf Or Fill Online Connecticut

Matt

What To Do When You Have An Estimated Tax Penalty H R Block

Calameo Irs 2566 Notice

Form 2210 Underpayment Of Estimated Tax By Individuals Estates

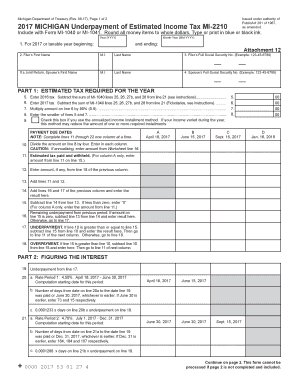

Irs Michigan Form Mi 2210 Pdffiller

What You Need To Know About The Estimated Tax Payment Due June 15