Form 2555 Ez 2019

If you previously filed form 2555 or form 2555 ez enter the last year you filed the form. Fill out forms electronically utilizing pdf or word format.

Us Internal Revenue Service I2555ez 2001 Pdf Document

The form 2555 ez will no longer be available to make the election to exclude foreign earned income and the foreign housing cost amount.

Form 2555 ez 2019. Download or print the 2019 federal form 2555 ez foreign earned income exclusion for free from the federal internal revenue service. Taxpayers qualifying under physical presence test see instructions 16. Approve forms using a lawful electronic signature and share them through email fax or print them out.

We will update this page with a new version of the form for 2021 as soon as it is made available by the federal government. Form 2555 2019 page. Improve your productivity with effective service.

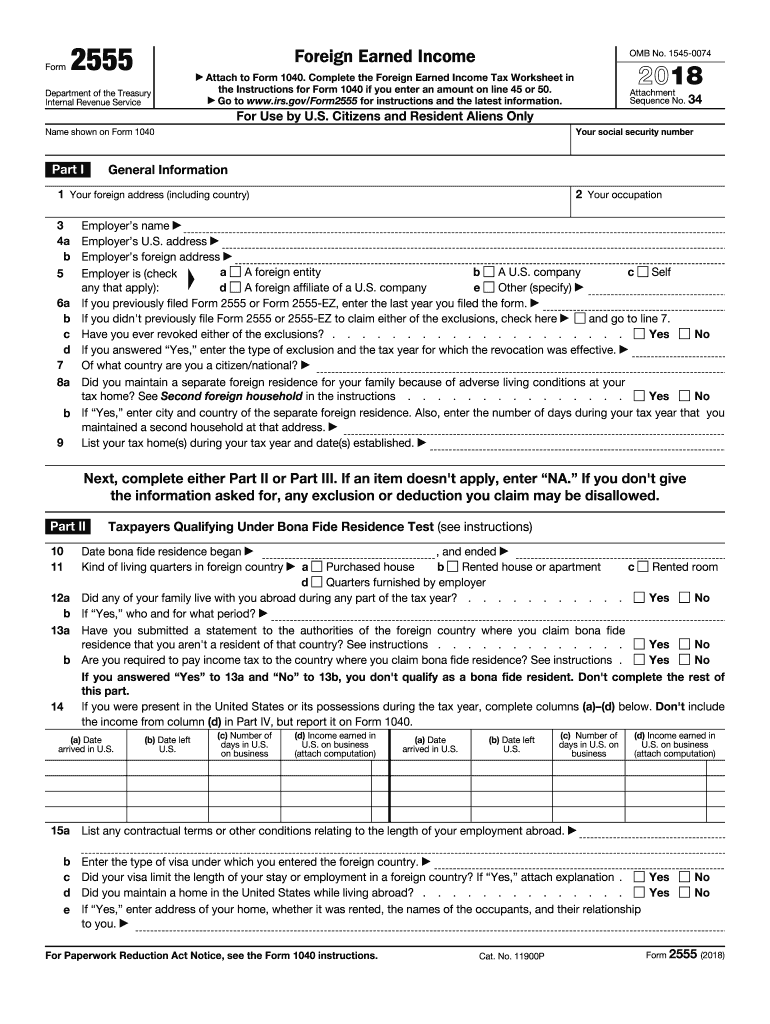

Form 2555 ez department of the treasury internal revenue service 99 foreign earned income exclusion attach to form 1040. If you qualify you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. We last updated federal form 2555 ez in january 2020 from the federal internal revenue service.

Download files on your computer or mobile device. Make them reusable by making templates include and complete fillable fields. Information about form 2555 foreign earned income including recent updates related forms and instructions on how to file.

Beginning with tax year 2019 all taxpayers will be required to use the form 2555 to claim the foreign earned income exclusion. The physical presence test is based on the 12 month period from. Beginning with tax year 2019 all taxpayers will be required to use the form 2555 to claim the foreign earned income exclusion.

This form is for income earned in tax year 2019 with tax returns due in april 2020. Foreign earned income exclusion 2019. Form 2555 shows how you qualify for the bona fide residence test or physical presence test how much of your foreign earned income is excluded and how to figure the amount of your allowable foreign housing exclusion or deduction.

Go to wwwirsgovform2555ez for instructions and the latest information. All taxpayers claiming the foreign earned income exclusion are required to use form 2555 for tax years beginning after 2018. Complete the foreign earned income tax worksheet in the instructions for form 1040 if you enter an amount on line 18.

Form 2555 ez will not be used after 2018 17 apr 2019 internal revenue service. The form 2555 ez will no longer be available to make the election to exclude foreign earned income and the foreign housing cost amount. For 2019 the maximum exclusion amount has.

2 part iii.

3 21 3 Individual Income Tax Returns Internal Revenue Service

Download 1040a 2014 Tax Form Excellent Instructions For Form Pdf

The Earned Income Tax Credit And How To Claim It

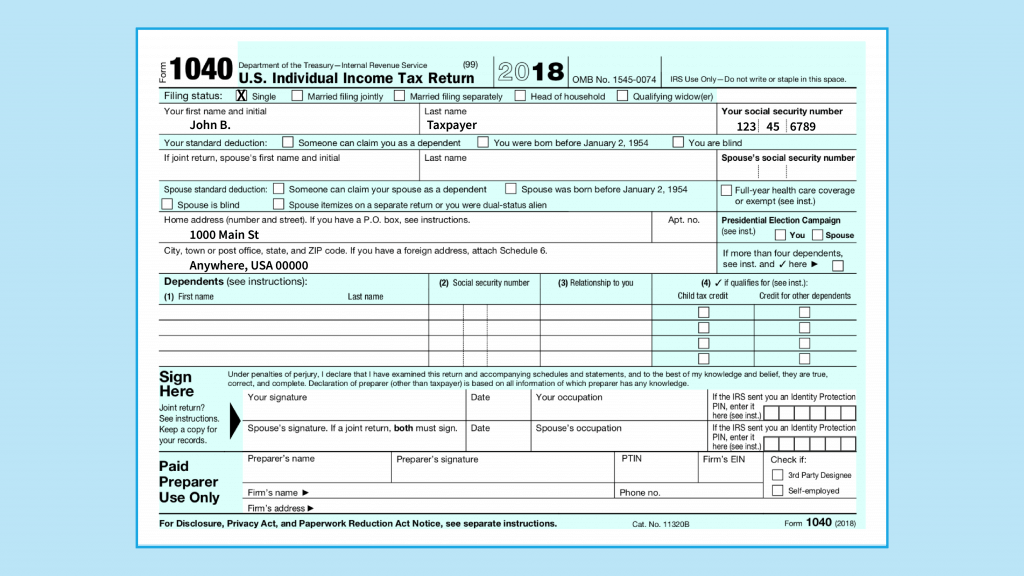

What Is The 1040 And What S The Difference Between The 1040 1040a

Irs Discontinues Schedule C Ez And Other Forms For 2019

Us Expat Taxes Form 2555 Ez Foreign Earned Income Exclusion

Form 2555 Fill Out And Sign Printable Pdf Template Signnow

Form 2555 Everything Expats Need To Know Bright Tax Expat Tax

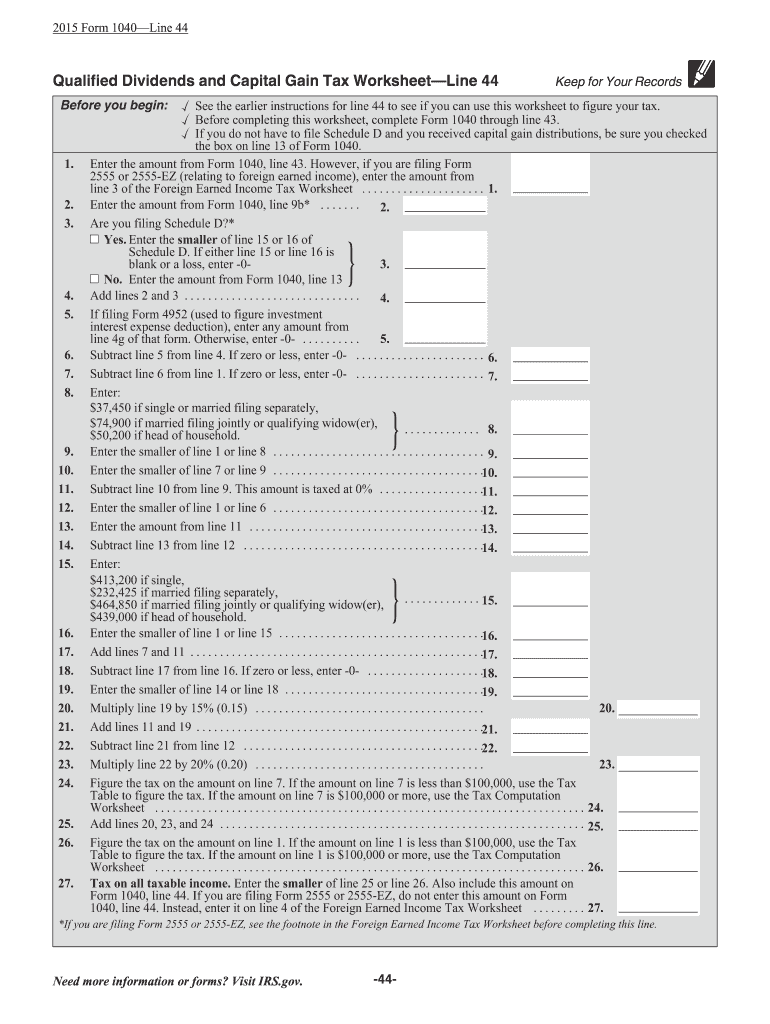

Qualified Dividends Worksheet Fill Out And Sign Printable Pdf