Form 2553 Example

Simply put by filling out and submitting for 2553 an entity is stating its intent to become an s corporation. Request relief on the grounds of reasonable cause.

Irs Form 2553 Instructions How And Where To File This Tax Form

Form 2553 begins on the next page.

Form 2553 example. The form is typically due by march 15 of the tax year for which it applies but the irs will accept it late if a company has. No prior tax year. Form 2553 filed after september 15 2005 will apply to the following tax year unless reasonable cause can be shown for making a late election.

Where to file form 2553 after 61719. An existing corporation with a taxable year that ends on december 31 2005 must have filed their election form 2553 by the previous march 15 2005 to be treated as an s corporation for 2005. Form 2553 must be filed before the 16th day of the third month of the corporations tax year or before the 15th day of the second month of a tax year if the tax year is 2½ months or lessyou can also file the form at any time during the tax year before the year in which you want the election to take effect.

For example if you incorporate in late december 2019 but miss the march 15th 2020 deadline you can always request that the election be effective for tax year 2021 by submitting form 2553 prior to january 1st 2021. Instructions for form 2553 introductory material. For the latest information about developments related to form 2553 and its instructions such as legislation enacted after they were published go to irsgovform2553.

For example if an s corporation by act or omission fails to meet even one of the criteria for eligibility the s status can be lost instantly potentially causing unexpected harm andor losses for the company and possibly its shareholders. For example if you have a new business and youre incorporating as an s corporation starting january 7 2019 you can file form 2553 between january 7 and march 21 2019. It does this by filing form 2553.

Once its complete form 2553 you submit it to the internal revenue service. If the corporations principal business office or agency is located in. Form 2553 instructions is a necessary step in order to qualify as an s corporation.

Its title is election by a small business corporation. To enjoy the tax advantages that come with being an s corporation a business must first inform the internal revenue service it is claiming s corp status. Fill out form 2553.

What Is Form 2553 And How Do I File It Ask Gusto

3 13 2 Bmf Account Numbers Internal Revenue Service

Irs Tax Notices Explained Landmark Tax Group

What Is Form 2553 And How Do I File It Ask Gusto

Irs Filing February 2017

3 13 2 Bmf Account Numbers Internal Revenue Service

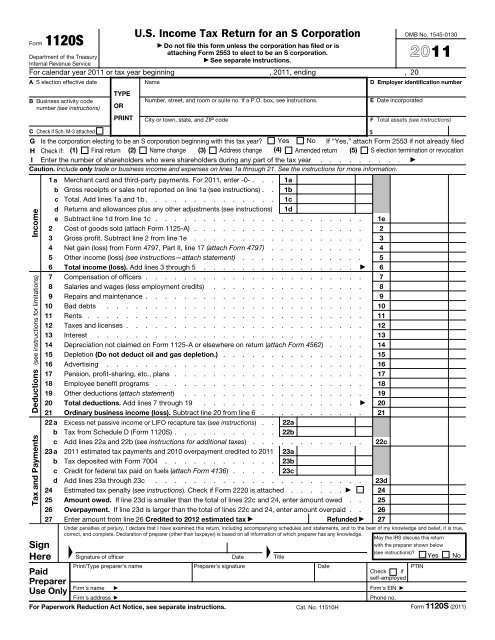

U S Income Tax Return For An S Corporation Irs Video Portal

How To Fill Out Irs Form 2553 Easy To Follow Instructions Youtube

Learn How To Fill The Form 2553 Election By A Small Business