Form 2106 Tax Return

Then scroll down and click delete next to form 2106. If you qualify complete form 2106 and include the part of the line 10 amount attributable to the expenses for travel more than 100 miles away from home in connection with your performance of services as a member of the reserves on schedule 1 form 1040 or 1040 sr line 11 and attach form 2106 to your return.

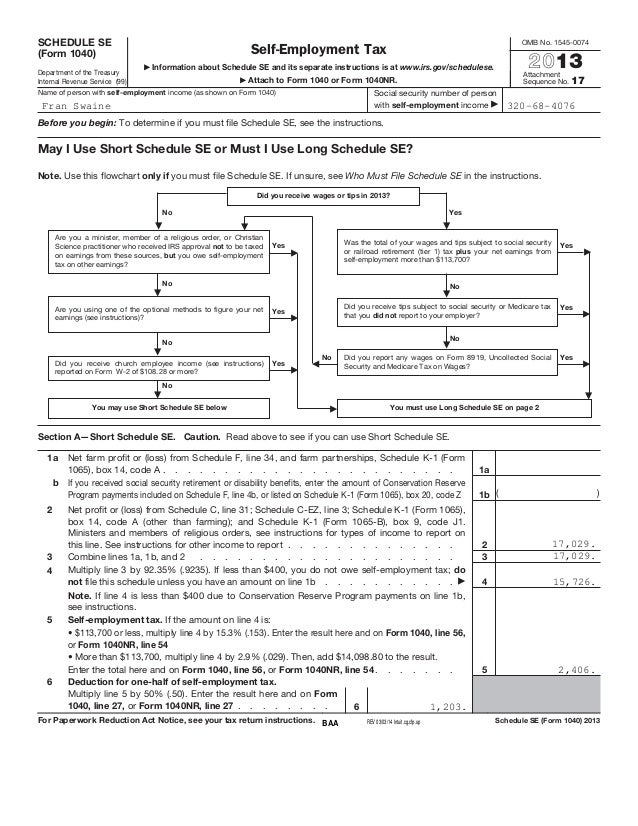

2106 Employee Business Expenses 2106 Schedule1

However with tax reform all miscellaneous 2 expenses including unreimbursed employee expenses are not allowed between 2018 and 2025.

Form 2106 tax return. Log into your account and click take me to my return. Employees file this form to deduct ordinary and necessary expenses for their job. Under the tax cuts and jobs act tcja that congress signed into law on december 22 2017 the unreimbursed employee expenses deduction has been suspended in tax years 2018 through 2025.

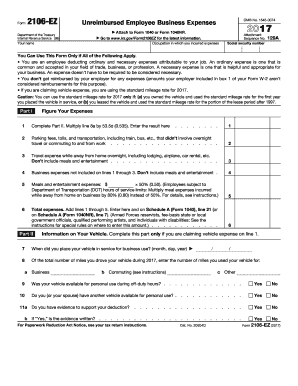

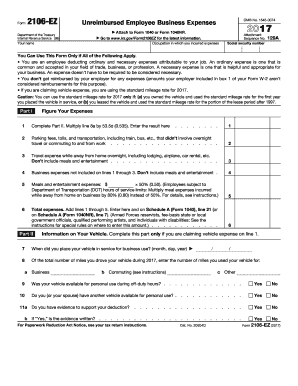

There are a few factors youll want to consider when deciding which form to use. About form 2106 ez unreimbursed employee business expenses. For tax years through 2017.

Beginning in 2018 unreimbursed employee expenses are no longer eligible for a tax deduction. These instructions only apply to 2017 or earlier tax year returns. You can use the steps below to help you delete form 2106 if you are using turbotax online.

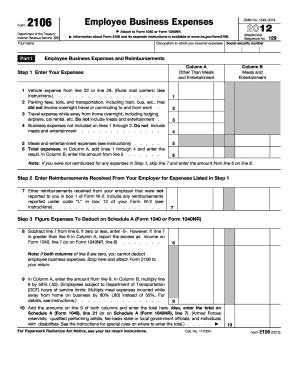

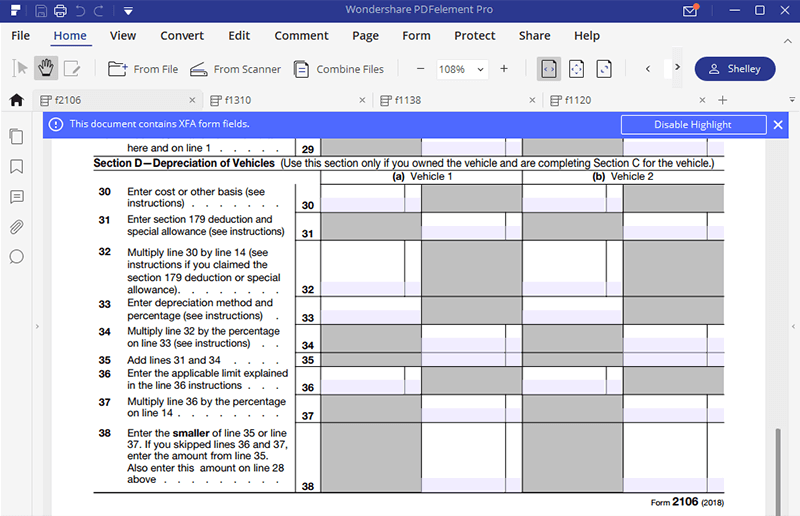

Click delete a form from the pop up that appears. Employee business expenses was a tax form distributed by the internal revenue service irs used by employees to deduct ordinary and necessary expenses related to their jobs. Form 2106 department of the treasury internal revenue service 99 employee business expenses for use only by armed forces reservists qualified performing artists fee basis state or local.

Form 2106 note. For tax years after 2017 unreimbursed employee expenses are no longer deductible. For tax years prior to 2018 use the irs forms 2106 and 2106 ez for claiming non reimbursed expenses you incur during your normal course of work.

An ordinary expense is one that is common and accepted in your field of trade business or profession. For tax years through 2017 use irs form 2106 if you itemize deductions for non reimbursed work related expenses such as travel meals entertainment or transportation. About form 2106 employee business expenses.

You can use form 2106 ez instead of form 2106 to claim your unreimbursed employee business expenses if you use the standard mileage rate for claiming vehicle expense. A necessary expense is one that is helpful and appropriate for your business. Heres how to enter your job related expenses in turbotax 2017 or earlier.

Then click tax tools to the left and then tools. Expenses such as union dues work related business travel or professional organization dues are no longer deductible even if the employee can itemize deductions. Ordinary expenses were generally considered common and accepted in a particular line of business.

Pdf Transfer Of Persistence To The Acquisition Of A New Behavior

Turbo Taxreturn

3 Tax Breaks That Are About To Disappear The Motley Fool

Fillable 2012 Form 2106 Fill Online Printable Fillable Blank

2017 2020 Form Irs 2106 Ez Fill Online Printable Fillable Blank

Individual Income Tax Faq Alabama Department Of Revenue

Overview Fms Tax Services

How To Deduct Unreimbursed Business Expenses Without Itemizing

To Fill In Irs Form 2106