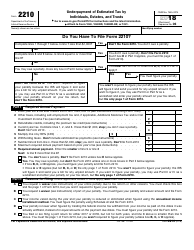

Irs Form 2210 For 2018

Tax guide for us. Underpayment of estimated tax by farmers and fishermen 2019 01092020 inst 2210 f.

W 4 Worksheet

Who must pay the underpayment penalty.

Irs form 2210 for 2018. About form 2210 underpayment of estimated tax by individuals estates and trusts. Instructions for form 2210 underpayment of estimated tax by individuals estates and trusts 2019 02192020 form 2210 f. In general you may owe the penalty for 2018 if the total of your withholding and timely estimated tax payments didnt equal at least the smaller of.

You arent required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. You must check this box and file page 1 of form 2210 but you arent required to figure your penalty. Dont file form 2210.

B you request a waiver see instructions of part of your penalty. Use this form to see if you owe a penalty for underpaying your estimated tax and if you do to figure the amount of the penalty. If you use the regular method complete part i check the boxes that applies in part ii complete part iv section a and the penalty worksheet later.

A you request a waiver see instructions of your entire penalty due to tax reform or other reasons. Circular a agricultural employers tax guide 2018 12312018 publ 54. Notice concerning fiduciary relationship.

100 of your 2017 tax. Enter the penalty on form 2210 line 27 and on the estimated tax penalty line on your tax return. Form 2210 line 17 and on the estimated tax penalty line on your tax return.

Refigure lines 6 and 7 through 9 on your 2018 form 1040 and use the refigured 2018 form 1040 line 10 amount in calculating your 2018 tax for form 2210 line 8. Dont file form 2210. Instructions for form 2210 underpayment of estimated tax by individuals estates and trusts 2019 02192020 form 2210 f.

You may exclude the amount of your net tax liability under section 965 when calculating the amount of your maximum required annual payment based on your prior years tax. If you want to figure it you may use part iii or part iv as a worksheet and enter your penalty amount on your tax return but. Internal revenue service data book 0519 06142019 form 56.

If none apply dont file form 2210. Underpayment of estimated tax by individuals estates and trusts 2019 02192020 inst 2210. Underpayment of estimated tax by individuals estates and trusts 2017 inst 2210.

Instructions for form 2210 f underpayment of estimated tax by farmers and fishermen 2019. Underpayment of estimated tax by individuals estates and trusts 2018 inst 2210. Citizens and resident aliens abroad 2019 12262019 publ 55 b.

90 of your 2018 tax or 2. Underpayment of estimated tax by farmers and fishermen. Instructions for form 2210 underpayment of estimated tax by individuals estates and trusts 2018 form 2210.

Enter the penalty on form 2210 line 27 and on the estimated tax penalty line on your tax return.

Publication 505 2019 Tax Withholding And Estimated Tax

2

Irs Waives Penalties For Qualifying Farmers Fishermen

Special 2018 Underpayment Penalty Relief Expanded To Apply To

Irs Form 2210 Download Fillable Pdf Or Fill Online Underpayment Of

Tax Penalty For Failure To File Failure To Pay Or For Underpaying

1040 2019 Internal Revenue Service

Prepare 2019 Irs Federal Tax Forms And Schedules To E File In 2020

Irs Announces Enhanced Penalty Relief For Some 2018 Taxpayers