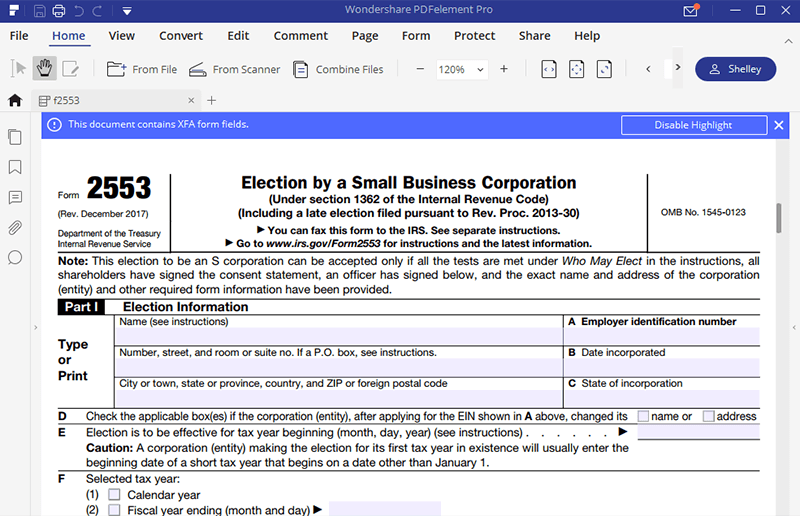

Form 2553 Instructions

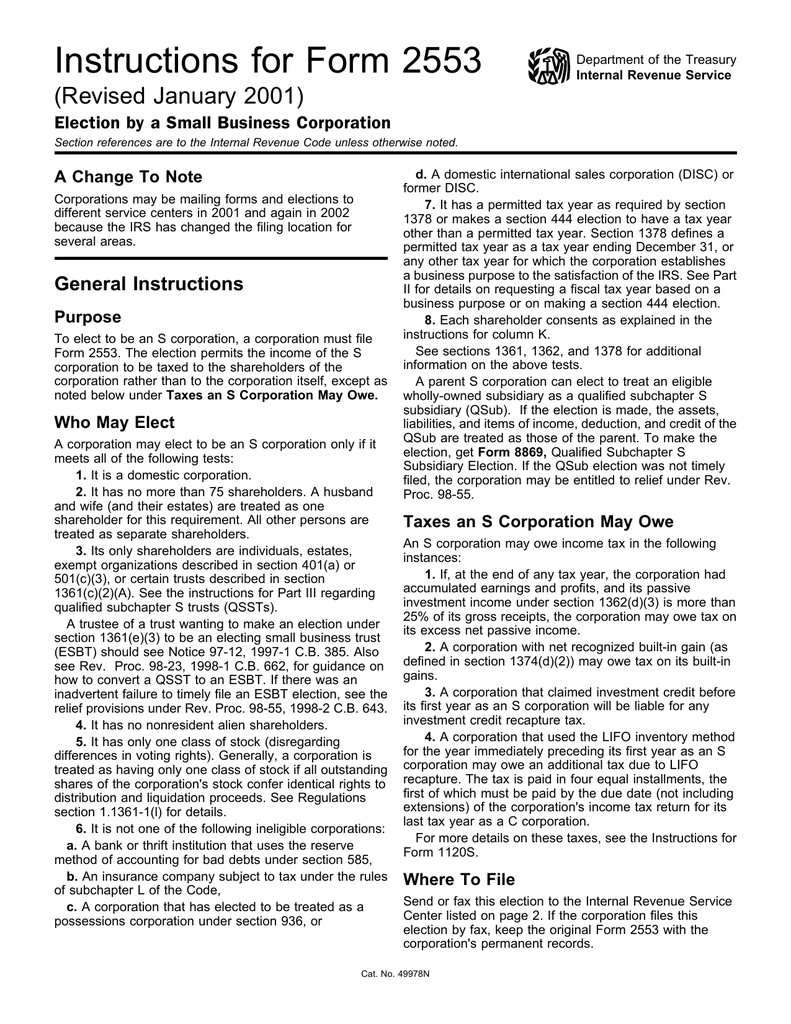

When box q1 is checked it will generally electing to be treated. Form 2553 instructions is a necessary step in order to qualify as an s corporationits title is election by a small business corporation.

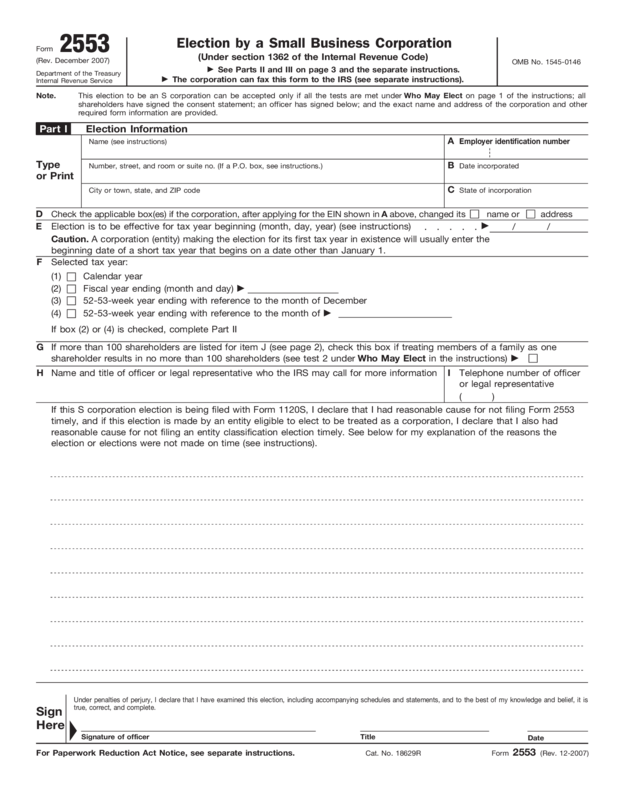

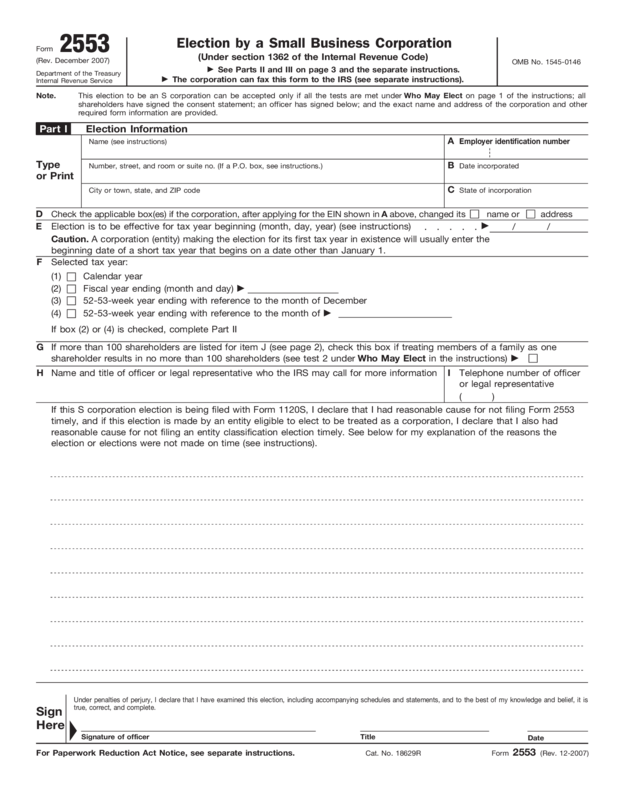

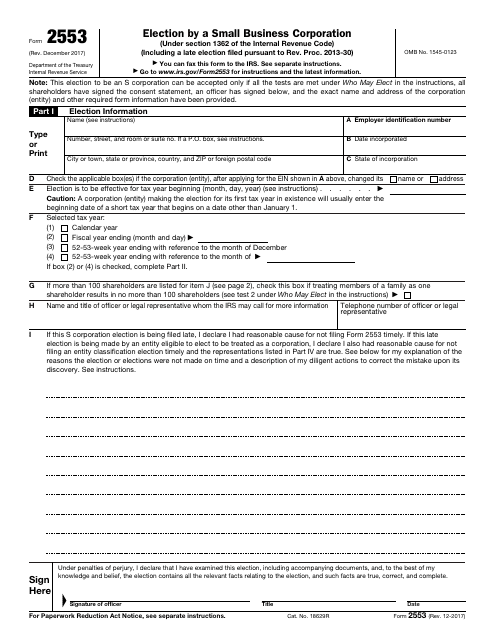

Form 2553 Rev December 2007 Edit Fill Sign Online Handypdf

Qualified subchapter s trust election.

Form 2553 instructions. E of form 2553. The instructions for form 2553 begins on the next page. A qsst is a type of trust with a single beneficiary.

Once its complete form 2553 you submit it to the internal revenue service. Part iii form 2553 instructions. A qualified subchapter s trust qsst that wants to hold stock in an s corp must fill out part iii of irs form 2553.

Election by a small business corporation 1217 06132019 inst 2553. Instructions for form 2553 introductory material future developments for the latest information about developments related to form 2553 and its instructions such as legislation enacted after they were published go to irsgovform2553. Where to file form 2553 after 61719.

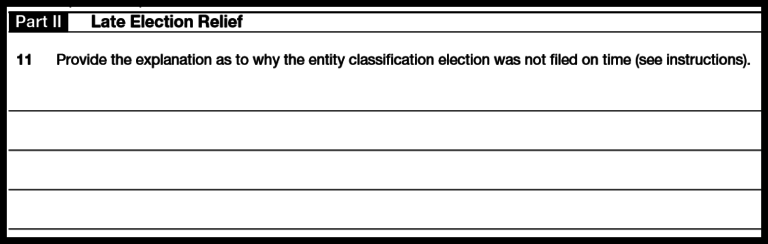

Instructions for form 2553 election by a small business corporation 1217 06132019 previous. Forms and publications pdf instructions. Q1 in part ii is checked the corporation will receive a ruling similar relief is available for an entity eligible to elect to be letter from the irs that either approves or denies the treated as a corporation see the instructions for form 8832 selected tax year.

If the corporations principal business office or agency is located in. Part iii of irs form 2553 doesnt apply to most small businesses.

Form W 9 And Instructions Thereto

3 Ways To File An Llc As An S Corp For Taxes Wikihow

Instructions For Form 2553 Manualzz

Irs Form 2553 Download Fillable Pdf Or Fill Online Election By A

Steps For Electing Sub S Status For Washington Llc Or Corp

Irs Form 2553 No Error Anymore If Following The Instructions

Irs Form 8832 Instructions Faqs

What Is An Irs Form 2553 S Corporation Election

S Corp Form 1120s Youtube