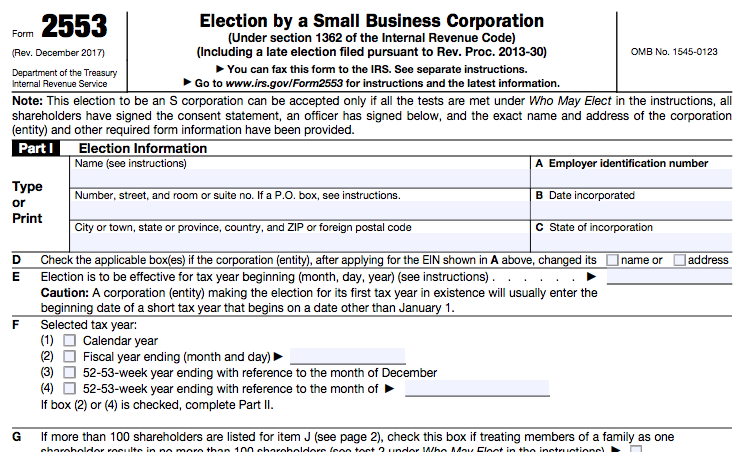

Completed Form 2553 Example

You can also file the form at any time during the tax year before the year in which you want the election to take effect. How to fill in form 2553 election by a small business corporation s election duration.

Video Tips For Filling Out Irs Form 2553 Election By A Small

On monday we discussed the tax benefits of electing to be taxed as an s corporation.

Completed form 2553 example. Under penalties of perjury i certify that the trust meets the definitional requirements of section 1361d3 and that. Form 2553 must be filed before the 16th day of the third month of the corporations tax year or before the 15th day of the second month of a tax year if the tax year is 2½ months or less. Bette hochberger inc 23450 views.

For example if you have a new business and youre incorporating as an s corporation starting january 7 2019 you can file form 2553 between january 7 and march 21 2019. Because the corporation had a prior tax year. In order for the trust named above to be a qsst and thus a qualifying shareholder of the s corporation for which this form 2553 is filed i hereby make the election under section 1361d2.

By josh bauerle 1 comment. To be an s corporation beginning with its next tax year the corporation must file form 2553 during the period that begins the first day january 1 of its last year as a c corporation and ends march 15th of the year it wishes to be an s corporation. The way to make this election is filing form 2553 with the irs.

How to fill out form 2553. If you had a business that was incorporated as a c corporation in 2018 and youre changing to an s corporation starting in 2019 you can file form 2553 at any time in 2018 or within the first two months and 15 days of 2019. While i recommend using a cpa to do this heres a video for all you crazy kids wanting to do it yourself.

S Corp Vs C Corp Differences Benefits Bizfilings

Example 1040 Form Filled Out Inspirational Form 1040 Example New

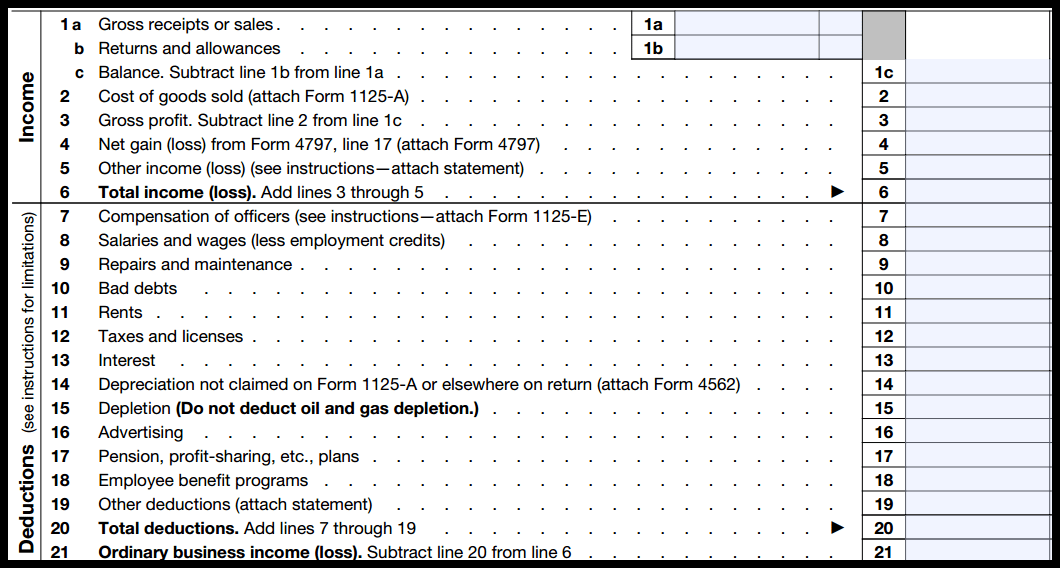

Irs Form 1120s Definition Download 1120s Instructions

What Is Form 2553 And How Do I File It Ask Gusto

S Corp Vs C Corp How They Differ And How To Decide

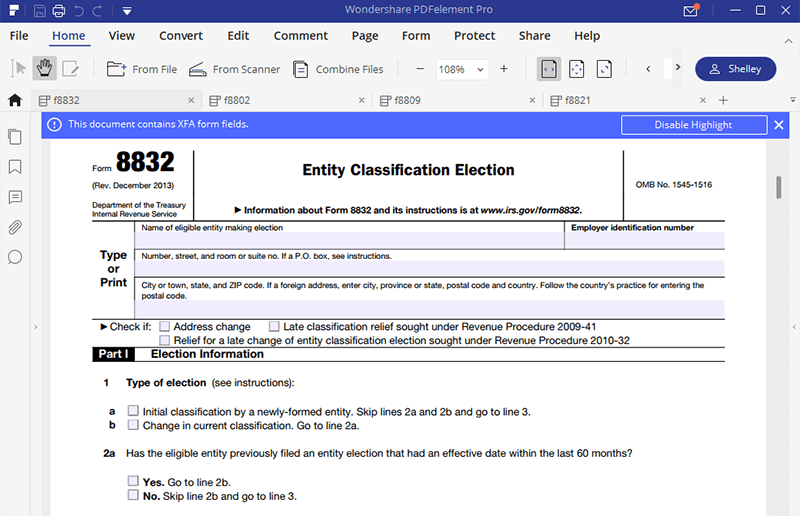

Filling Out Irs Form 8832 An Easy To Follow Guide Youtube

Irs Form 8832 How To Fill It Right

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Irs Form 2553 Instructions How And Where To File This Tax Form