Form 2553 Instructions Where To File

Under election information fill in the corporations name and address along with your ein number and date and state of incorporation. Where to file form 2553.

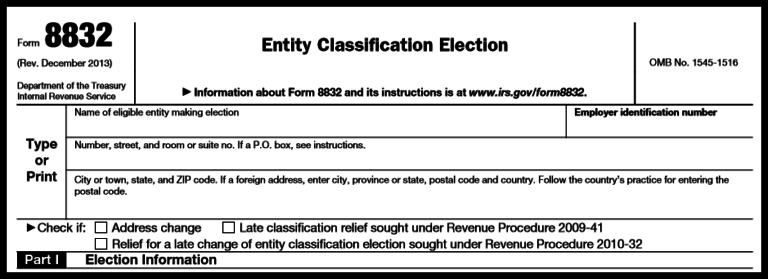

Irs Form 8832 Instructions Faqs

The form is organized into 4 sections for those opting for s corporation election.

/changing-your-llc-tax-status-to-a-corporation-or-s-corp-398989-FINAL-30a3f0642aff40d49a8a23d4405f207f.png)

Form 2553 instructions where to file. You cannot file this form online. Specific instructions to file form 2553 are listed on the internal revenue service web site. Based on your businesss principal business location use the addresses or fax numbers shown above to file.

To be an s corporation beginning with its next tax year the corporation must file form 2553 during the period that begins the first day january 1 of its last year as a c corporation and ends march 15th of the year it wishes to be an s corporation. Under item e provide an effective date for election which is based on the date your corporation first had shareholders assets or began doing business. Because the corporation had a prior tax year.

How to file usually form 2553 is a four page form that contains information about a business and its shareholders. Current irs mailing address httpswwwirsgovfilingwhere to file your taxes for form 2553 how long does it take for form 2553 to get approved. The mailing address will vary depending on the state the business is located.

Filing options for form 2553 include mail and fax filing. Make sure you double check the irs website because addresses and fax numbers can change periodically. Must file form 2553 during the period that begins the first day january 1 of its last year as a c corporation and ends march 15th of the year it wishes to be an s corporation.

If the corporations principal business office or agency is located in use the following irs center address or fax number connecticut delaware district of columbia georgia illinois. Find mailing addresses by state and date for filing form 2553. The form is organized into 4 sections for those opting for s corporation election.

Form 2553 can be filed by mail or fax as there is no online submission. The information you provide impacts whether the irs will approve s corporation tax status and when the status will take effect.

Irs Form 2553 Instructions How And Where To File This Tax Form

/changing-your-llc-tax-status-to-a-corporation-or-s-corp-398989-FINAL-30a3f0642aff40d49a8a23d4405f207f.png)

Change Your Llc Tax Status To A Corporation Or S Corp

Irs Form 2553 Halon Tax Help Center

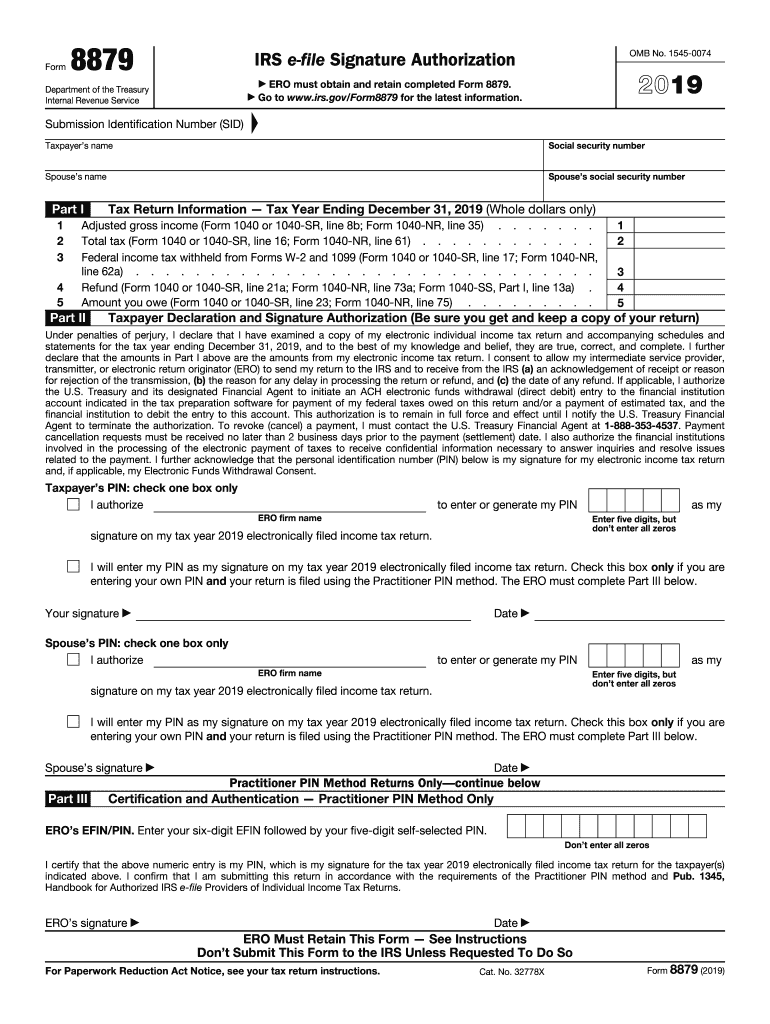

Irs 8879 2019 Fill Out Tax Template Online Us Legal Forms

How To Fill Out Irs Form 2553 Easy To Follow Instructions Youtube

Can I Convert My Llc To An S Corp When Filing My Tax Return

3 13 222 Bmf Entity Unpostable Correction Procedures Internal

3 13 222 Bmf Entity Unpostable Correction Procedures Internal

Where Do I Send Form 2553 Inspirational Calendar Bticpa Models