Form 2441 Child And Dependent Care Expenses

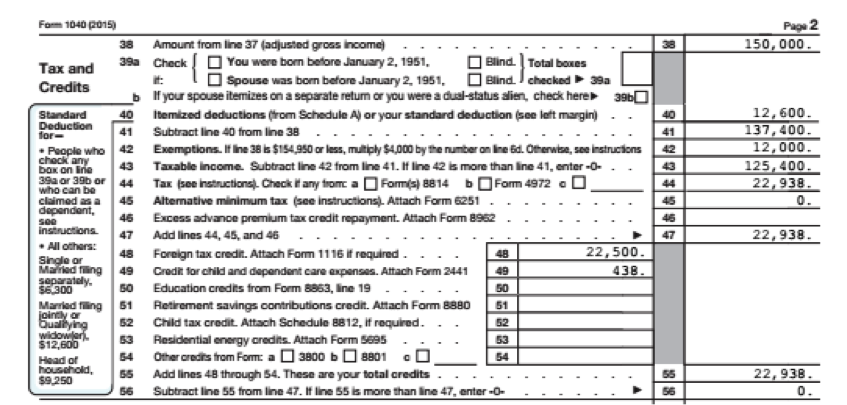

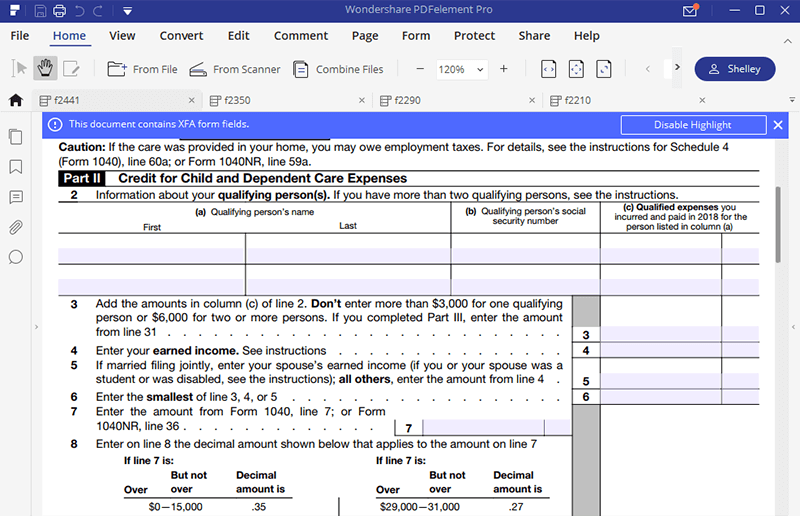

If your filing status is married filing separately and you meet the requirements to claim the credit for child and dependent care expenses complete the statement above part i on form 2441 by checking the checkbox confirming you meet those requirements listed earlier under married persons filing separately and who can take the credit or exclude dependent care benefits. Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit.

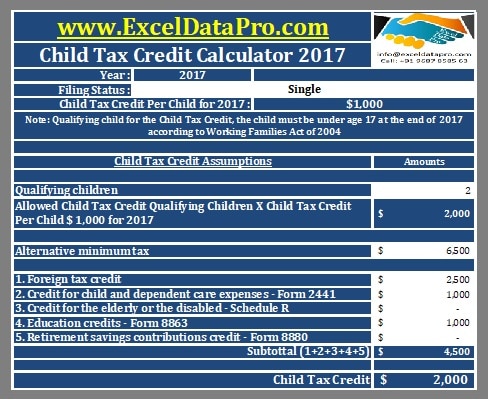

Download Child Tax Credit Calculator Excel Template Exceldatapro

Child and dependent care expenses and attach it to your form 1040 to claim the credit.

Form 2441 child and dependent care expenses. They complete part iii of form 2441 to exclude the 1000 from their taxable income offsetting 1000 of their expenses. Faq interest dividends other types of income. Form 2441 child and dependent care expenses is an internal revenue service irs form used to report child and dependent care expenses on your tax return in order to claim a tax credit for those.

On site care for their employees children. Form w 10 dependent care providers identification and certification publications. Direct payment for third party care.

In addition if you or your spouse if filing jointly received any dependent care benefits for 2019 you must use form 2441 to figure the amount if any of the benefits you can exclude from your income. They received 1000 of dependent care benefits from megans employer during 2018 but they incurred a total of 19500 of child and dependent care expenses. Part i persons or organizations who provided the care you.

Instructions for form 2441 child and dependent care expenses. You cannot claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the requirements listed in the instructions under married persons filing separately if you meet these requirements check this box. You must complete part iii of form 2441 before you can figure the credit if.

Some employers provide childcare benefits like. If you hire someone to care for your disabled spouse or a dependent and you report income from employment or self employment on your tax return you may be able to take the credit for child and dependent care expenses on form 2441. Taking care of a child or disabled loved one is a difficult financial strain.

If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses. Publication 503 child and dependent care expenses frequently asked questions. The cost of childcare becomes more and more expensive every year and if your disabled loved one doesnt have the best insurance dependent care can cost you a huge portion of your income.

Accounts earmarked for childcare expenses. Take the credit for child and dependent care expenses.

Your Us Expat Tax Return And The Child Care Credit

Use This Important Tax Benefit To Save Money On Your Child And

Form 2441 Dependent Care Expenses Legal Forms

Editable Irs Instructions 2441 2019 Create A Digital Sample In Pdf

What To Know About Summer Child Care Expenses

Instructions For How To Fill In Irs Form 2441

Child And Dependent Care Expenses

2441 Child And Dependent Care Credit W2

Simpletax Form 2441 Youtube