Form 2210ai Instructions

Instructions for form 2210 html. Enter a term in the find box.

/31844337457_bc187b1e6e_k-6335cb7fd1104606b62f5194903cd89b.jpg)

Underpayment Penalty Defined

Select a category column heading in the drop down.

Form 2210ai instructions. The irs will figure the penalty for you. Click on column heading to sort the list. Click on column heading to sort the list.

Use this form to see if you owe a penalty for underpaying your estimated tax and if you do to figure the amount of the penalty. Who must file form 2210 use the flowchart at the top of form 2210 page 1 to see if you must file this form. Subtract line 6 from line 4.

Click on the product number in each row to viewdownload. If box b c or d in part ii is checked you must figure the penalty yourself and attach form 2210 to your return. You dont owe a penalty.

If a taxpayer does not honor an irs installment agreement the irs measures the tax deficiency by comparing each quarterly payment as it appears in form. Click on the product number in each row to viewdownload. You may be able to enter information on forms before saving or printing.

Use form nj 2210 to determine if you are subject to interest on the underpayment of estimated tax. There are some situations in which you must file form 2210 such as to request a waiver. Subject to interest on underpayment of estimated tax and may need to complete form nj 2210 except estates and trusts.

Multiply line 4 by 90 090. Estates and trusts are. General instructions future developments for the latest information about developments related to form 2210.

Select a category column heading in the drop down. File form 2210. Instructions for form 2210 underpayment of estimated tax by individuals estates and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted.

File form 2210. About form 2210 underpayment of estimated tax by individuals estates and trusts. Form 2210 instructions the irs uses form 2210 for underpayment of estimated tax form 2210 f for farmers and fishermen to track whether estimated taxes have been paid in full and on time.

If less than 1000 stop. Enter a term in the find box. Include estimated tax payments see instructions.

You may be able to enter information on forms before saving or printing. The internal revenue service form 2210 is used to calculate and report an underpayment of estimated taxes paid. Instructions for form nj 2210 underpayment of estimated tax by individuals estates or trusts.

Amazon Com Turbotax Deluxe 2016 Tax Software Federal State

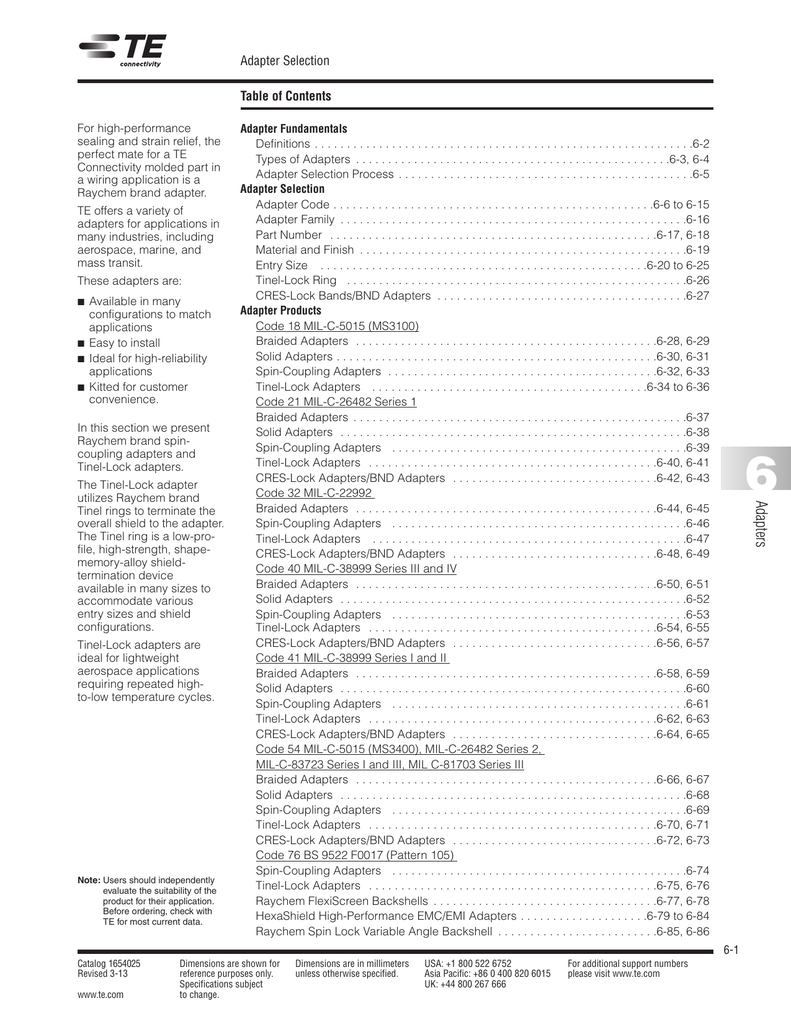

Table Of Contents Adapter Selection Manualzz

Https Www Irs Gov Pub Irs Utl 2012 4f Faqs Pdf

Are You Withholding Enough For 2018 Modified Income Tax Tables

Ephedra Diet Pills Reviews Meimicotu

Https Www Irs Gov Pub Irs Utl 2012 4f Faqs Pdf

Form Ia 2210 Ai Schedule Ai Annualized Income Installment Method

Gummin2018 Pdf Health Care Public Health

Form Ia 2210 Ai Schedule Ai Annualized Income Installment Method